The rise of DNVBs in Brazil

Latin America’s most populous country has become one of the most dynamic markets for DNVBs (Digitally Native Vertical Brands). We are witnessing the growth of companies that are revolutionizing some traditional sectors like Beauty, Food, CPGs, and Fashion.

But first, what do we mean by DNVB?

DNVBs are brands that are digitally native, sell primarily through the Internet, and own and maintain control of their supply chain from end to end. These are startups that aim to build a direct relationship with the customer instead of relying on a “middle man”. One of the greatest benefits of this strategy is that it enables these businesses to keep their margins for themselves and not have to share them with anyone else (distributors, marketing agencies, resellers, etc).

According to Andy Dunn — founder of Bonobos and the creator of the term DNVB — a digitally native vertical brand typically meets four criteria:

1. It’s primary means of interacting, transacting, and storytelling to consumers is via the web. In almost all cases the brand is born digitally. Hence the name digitally native.

2. It’s a brand, and that brand is vertical. The name of the brand is on both the physical product and on the website. It requires the commercialization of an e-commerce channel, but that channel is an enablement layer, not the core asset.

3. The DNVB is usually maniacally focused on customer experience and on customer intimacy. The experience tends to be a three-part bundle of physical product, web/mobile experience, and customer service that collectively become the brand in the consumer’s imagination.

4. While born digitally, the brand rarely ends up digital only. This means the brand can extend offline, eventually. Usually its offline incarnation is through its own experiential physical retail or highly selective partnerships. In nearly all cases of partnerships, the brand controls its external distribution versus being controlled by it.

In the US, there is an expansion of DNVBs in every major consumer category, altering the retail landscape. Up to 90% of the traditional Top 100 Consumer Packaged Goods (CPG) brands reported to have lost market share, while smaller brands have grown.

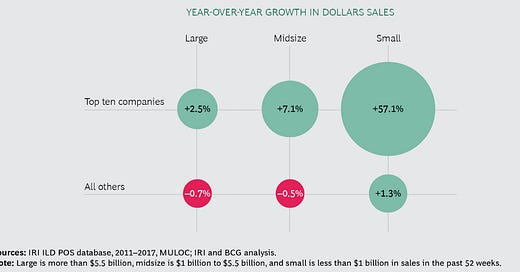

A report from BCG in 2018 shows that growth leaders are substantially outperforming their peers in this category.

Companies like Warber Parker, Casper, Harrys, SmileDirectClub, 23andMe, Hims have modified their sectors landscape with the direct to consumer approach. This trend can be noticed by observing the data in the graphic below, which reveals that DNVBs brands grew three times faster than total US e-commerce in 2017.

In the face of this growth, there is a concern in more mature markets (i.e. US) due to changing market forces that are happening in this sector. Customer acquisition was lower in the early days and currently, DNVBs may need a stronger strategy around retention and customer experience to increase the LTV/CAC ratio(relationship between the lifetime value of a customer and the cost of acquiring that customer).

My thesis is that in Brazil we are still in the early days of this market due to few reasons that I will list below and it represents an amazing opportunity for founders that aims to build companies with operational excellence and sustainable customer relationship.

Why Brazil is a great landscape for DNVBs

Some global trends benefit from the growth of this new retail category, and Brazil represents a great landscape for DNVBs for a few distinct reasons:

Internet and Mobile Penetration

Brazil is the country in the Western Hemisphere with the highest per capita rate of time spent on social media platforms, which demonstrates how the online environment has matured throughout every level of Brazilian society (as demonstrated in the graphs below).

Online sales are growing

Despite the internet’s high penetration in the Brazilian population, online sales market share is still lower than in other markets. On the other hand, it is growing at a faster rate and catching up fast. The pace can be more accelerated by the demographic structure from Brazil, which has a relevant young population, which historically is the booster of e-commerce.

Total Addressable Market

Brazil is the undisputed economic powerhouse of South America, with a GDP that tops $2 trillion, which ranks it eighth in the world in terms of the size of its economy. Its relatively young population of 208 million boasts a steadily growing middle class. A few facts:

The second biggest market for instagram is in Brazil, with more than 70 million users.

According to EuroMonitor, Brazil is the fourth largest beauty market in the world with a value of almost US $30 billion, which represents massive opportunities for innovative DNVBs that operate in this market.

Evolving consumer habits

There is an evolving tendency in Brazilian society. With increasing internet participation, consumers have become more aware of the range of products and services available to them. The bar has risen in terms of the quality expectations in their consumer experiences.

This is a global circumstance described in “The Rise of the 21st Century Brand Economy“ from IAB, as a “tidal shift” away from traditional to DTC (direct to consumer) brands.

“In the consumer economy, we are in the midst of a shift from a century-old ‘indirect brand economy’ to a ‘direct brand economy’. Brands characterized by their direct connections to consumers are disrupting the business model of market-leading brands which is leading to a new way of doing business. These direct brands are digitally savvy and fuelled by data and will be the growth engine of the new economy.”

Brazil loves local CPG companies

The Brazilian CPG market is intrinsically supportive of local companies while presenting challenges to international competitors. A new generation of CPG companies seems to be rising and benefiting from this Brazilian tradition of long-standing local companies.

According to a recent report about Brazilian consumer habits by Kantar, a company specialized in data, reveals that with the coronavirus pandemic altering the consumption habits of Brazilians, local brands grew in consumer preference and started to be purchased more frequently. The category represents more than 65% of the market in value. National brands have gained even more strength in Brazilian homes, with 84% in the food basket, 78% in dairy products, and 75% in-home care items.

The Competitive Brazilian Retail Landscape

To demonstrate how the Brazilian scenario is changing, I will map out the retail landscape along two axes: offline-native versus online-native companies, and brands versus retailers. DNVBs are located squarely in the upper right quadrant:

Some of the amazing DNVBs in Brazil

Sallve

Founders: Daniel Wjuniski, Julia Petit, Marcia Netto

Investors: Astella, Kaszek, Canary, Waldencast.

Year Founded: 2018

A true example of a brand following DNVB best practices, the brand has been developing a company around a deep relationship with its community of customers. The team of co-founders combines successful digital entrepreneurs with one of the most well-known beauty influencers in Brazil.

The company is focused on selling skincare products directly to consumers, using only safe and clean ingredients, building a place of trust where people can share their true concerns and needs, inform themselves about beauty and behavior and buy the products they were willing about.

Dr. Jones

Founders: Guilherme Campos e André Popoutchi

Investors: Astella, Igah Ventures, Norte Capital

Year Founded: 2013

Dr. Jones is a company that achieved Product-Market Fit on traditional retail distribution but made an amazing pivot to a DNVB model due to a couple of reasons:

The challenges of the classic retail distribution dilemma

Opportunity to create a company even more focused on the customers

They are a direct to consumer specialized men’s personal and skincare brand, able to offer performance products at a great price plus subscription options, in the digital realm where consumers can feel more confident researching and purchasing beauty products.

Amaro

Founders: Dominique Oliver, Lodovico Brioschi, Roberto Thiele

Investors: Bulb Capital

Year Founded: 2012

Amaro is a digitally native women’s fashion brand and they are one of the pioneers in the Brazilian DNVB market. They sell online and via digitally immersive brick-and-mortar “Guide Shops” where customers can try on the products and receive their orders at home.

LivUp

Founders: Henrique Castellani, Victor Santos

Investors: Kaszek, ThornTree Capital Partners, Endeavor Catalyst

Year Founded: 2016

LivUp is a DNVB that offers Brazilians convenient access to healthy and ready to heat organic meals. By using high-end tech and constantly optimizing the processes, the company is revolutionizing the massive food market.

My thesis is that exists an opportunity in Brazil to build new category-defining digitally-native, vertically-integrated brand (DNVB) companies that can dominate verticals of this huge Brazilian consumer market.

If you are interested in this market, feel free to talk with us. lucas@astellainvest.com

tks to

The rise of DNVBs in Brazil was originally published in Astella Investimentos on Medium, where people are continuing the conversation by highlighting and responding to this story.