Startups late-stage deals in Brazil during the second half of 2021

The only way to be successful as a VC fund is if your startups became unicorns 🦄

That's how the game flows.

You invest in many companies, and the hope is that a few will become big.

To become prominent as a tech company, the startup will probably need late-stage investors.

One way to investigate what late-stage investors desire is by digging deep into what they are investing in your geography. That's what I did for this article. I researched all the deals from series B invested in Brazil from July 21 to October 21 (2H 2021). My sources were: Pitchbook, Crunchbase and News.

I want to add that it is missing some companies, once that is a private market and there is asymmetry of information.

You can see all the deals that I tracked in this spreadsheet below (I will try to update on monthly basis)

General Data

22 companies

14 series B rounds

Local investors led only 4 deals. The others had global firms as co-leaders.

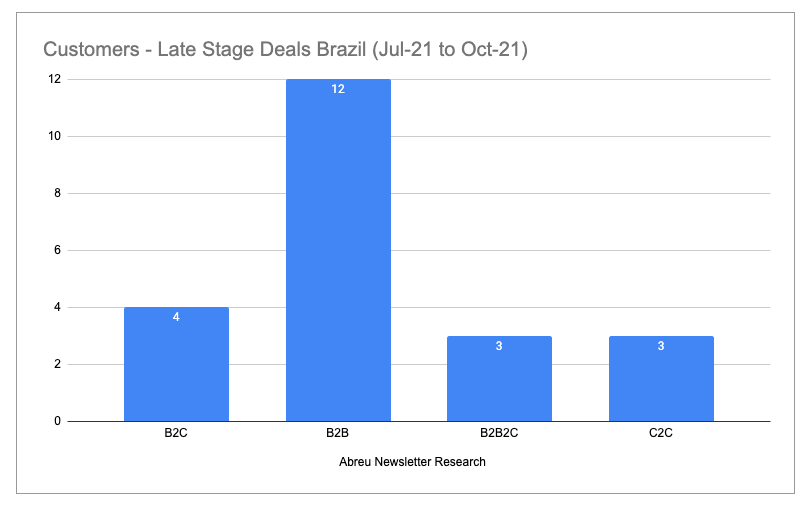

Deals breakdown

Opinions

Big Markets. Don Valentine (Sequoia founder) once said:

It’s better to invest in a company in a market with great demand than to invest in a company that has to create it.”

We can see that all late-stage deals were related to big markets in Brazil - six deals in fintech and 5 deals in mobility. Both are big problems to Brazilian consumers, and companies that usually had a significant market share in these markets are dinosaurs incumbents without a great digitalization agenda. I hope to see more companies in big sectors such as education and health in the next cohorts.

Foreign Capital. Almost all the investment had global firms as a leader. Softbank is the most important late-stage investor (9 investments). We have started to see the presence of prominent international funds such as Tiger, Coatue, and Greenoaks. Private Equity firms like Warburg and Advent made one big bet each in the past 4 months.

B2B prevalence. We can see that in this cohort, B2B had a significant presence. It is also interesting that mainly B2B companies in this cohort focus on fragmented markets such as SMB and micro-companies (Omie, Cloudwalk, Kovi, etc.)

Observations:

It's not only included in the cohort companies based outside Brazil and small extensions rounds.

Feedbacks?

If you have any feedbacks or ideas about this type of article, please reply to my email: lucasbarbosaabreulima@gmail.com or comment on the article.

I hope it can be helpful in some way. If it is valuable for the audience, I can go deep researching this topic (so please let me know if you enjoy it 👍).

I started with Brazil, but I can do it more broadly, including other Latin American countries.